KEEPING A BALANCED APPROACH

Source: Morningstar; Russell, MSCI, Dow Jones, Bloomberg, ICE BoA ML benchmarks shown; past performance is not indicative of future results

Summary:

Stocks across the globe have been on a tear over the past 12 months (see chart to the left).

Looking to stabilize a slowing labor market and with inflation closer to their 2% target, the Fed eased monetary policy by 50 bps in September.

You may have heard, there is an election coming in November …

Glass half-full:

Inflation (CPI) fell to 2.6% in August, providing the Fed cover to decrease the fed funds rate.

Recessionary indicators are not flashing red.

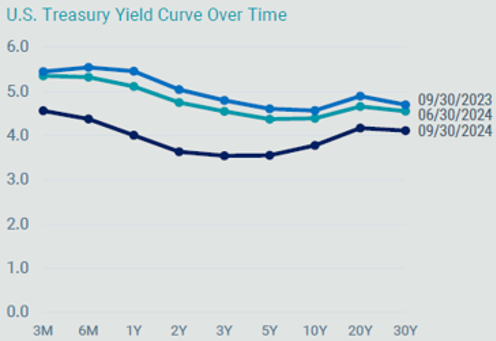

Parts of the yield curve have un-inverted (e.g., normalized to upward sloping), meaning bond investors are being compensated for term risk.

Glass half-empty:

The Fed’s concerns have shifted from inflation to the labor market. Unemployment rose slightly to 4.2% in August.

Geopolitics and the upcoming U.S. election have some investors’ nerves frayed.

Will China’s stimulus package happen, and will it be enough to boost consumer confidence and bolster their property market?

Watch the video commentary.

Q2 2024 by the numbers

4.75% - 5.00% is the new Fed policy rate as it pivoted lower by 50 bps in September. The Fed is trying to engineer a soft landing, which is an environment with low inflation and low unemployment.

2.6% and 2.2% were the August 2024 headline CPI and PCE figures, below the 3.3% and 2.6% figures from May, allowing the Fed to reduce the fed funds rate.

26 is the number of months the yield curve was inverted (measuring the spread between 2- and 10-yr. Treasuries). Note that short-term rates are still inverted.

3.2% was the Russell 1000 Growth index return for Q3, the lowest return of U.S. equity indexes we track for the quarter, and also lower vs. international indexes.

15.9% was the DJ Global Select REIT index return for Q3, the highest-returning index over the quarter we track.

35.8% is the amount the top 10 stocks in the S&P 500 comprise from a market capitalization perspective—slightly lower vs. last quarter but still high and considered relatively concentrated.

The Fed pivoted and eased monetary policy

With decreasing inflation but a slowing labor market, the Fed eased monetary policy by cutting the fed funds rate by 50 bps.

The Fed is trying to engineer a soft landing.

We have often talked about the Fed’s dual mandate of maintaining stable prices and having full employment. In an effort to combat high and rising inflation back in 2022, the Fed kept up a rapid pace of increasing the fed funds rate with the explicit goal of slowing inflation. We spoke about how it would take some time for these increases to work their way through the financial and economic system, and in August of 2023, the Fed was finally able to hit the pause button on rate increases. Since that time, there has been a debate on when the Fed would pivot and start lowering rates. In December 2023, predictions were that the Fed would pivot soon and that rates would decline throughout 2024. As an aside, this is exactly why we don’t base our investment approach on predictions, because we know they are often wrong, as they were in this case.

Fast-forward to September of 2024, when the Fed finally pivoted to lowering rates, cutting the fed funds rate by 50 bps. Part of what made this rate cut so interesting is that while the Fed was previously focused on inflation, Fed Chairman Powell’s remarks indicate the Fed’s main concerns had clearly shifted from inflation, which has been cooling, to the labor market, which has begun to soften.

Now that the Fed has made this initial cut, the questions relate to the Fed’s next move. How low will rates go? Chairman Powell said he doesn’t think we are going back to ultra-low interest rates. When will the next rate cut be? How large will it be? The Fed will continue to be data-dependent when it comes to making future decisions regarding any additional rate changes.

So much emphasis is being placed on the Fed as they are trying to engineer what is referred to as a soft landing, which is seen as a period where inflation is able to cool while at the same time not impeding growth and where there is still relatively low unemployment. In simple terms, the Fed is looking to stave off a recession. As the old economic saying goes, expansions do not die from old age; they die from imbalances or policy mistakes. In contrast, a hard landing is a period of more unemployment, higher inflation, and/or declines in growth. Where we stand today, most economists are still predicting a soft landing with no recession in sight and consumers still spending.

How Do U.S. Stocks and Bonds Perform After a Rate Cut?

It’s a fair and good question, though the answer is it depends on why the Fed is cutting rates in the first place.

Exhibit 1 shows that the S&P 500, which we will use as a proxy for U.S. stocks in this instance, has moved differently over various periods following rate hikes. In the scenario where the Fed is cutting rates because there are economic concerns and challenges (think of the dot-com bust of 2001 or the Great Financial Crisis in 2007), it is not surprising that equity markets can fall following a rate cut.

However, when the Fed is cutting rates because of what is deemed more positive news like falling inflation, it is possible that U.S. stock markets will increase. Plus, lower interest rates should make stocks more attractive relative to bonds, which can also serve to increase the value of stocks. Does this mean you want to load up on U.S. stocks now that the Fed has lowered rates? Not necessarily. Regardless of several valuation measures we can look at (e.g. P/E, CAPE, P/B), current U.S. stock valuations show as overvalued vs. their last 30-yr average. This is another example of why we don’t try to time the markets.

Exhibit 1

Source: FactSet, Federal Reserve, LSEG Datastream, S&P Global, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Excludes 1998 episode due to the short length of the cutting cycle and economic context for the cuts. Guide to the Markets – U.S. Data are as of September 30, 2024.

As it relates to bonds, while the Fed’s decision impacts the short end of the yield curve (i.e., cash), the rest of the yield curve is driven by market expectations. With the Fed initiating a rate decrease in September, investors still sitting in cash need to prepare to see the interest rates they are receiving decline.

At the same time, we wouldn’t suggest making too many changes simply based on watching what the Fed does. Exhibit 2 shows the change in the 10-year U.S. Treasury yield from July 2023 through September 24. Throughout this 14-month period, there were multiple FOMC meetings where the Fed didn’t change the fed funds target. And as the chart shows, there have been upward and downward shifts in the 10-yr Treasury. In other words, the return of the 10-yr Treasury is more based on future market expectations than it is based on the movement of the fed funds rate. What is also interesting to note is that the 10-yr US Treasury yield actually increased by 16 bps (3.65% to 3.81%) from the night before the Fed’s decision through month end. Why did it increase rather than decrease? This somewhat unexpected shift could be the result of investors believing the risks of a recession in the U.S. decreased due to the 50 bps rate cut, meaning investors are less interested in owning Treasuries, so Treasury prices decreased (and yields move inversely with prices).

Exhibit 2

Source: U.S. Department of the Treasury.

Where are rates headed from here? As you know, we are not in the business of making predictions, but we do understand how markets generally work. It all depends on expectations. Where we currently sit with a relatively strong economy and a small risk of recession, it is possible that yields may not decline much further. This is because the possible future impact of rate cuts has already been priced into the market. That being said, if a recession were to occur, then we would likely expect to see yields decrease on the 10-yr Treasury. Finally, it is important to note that high-quality corporate bonds, to which we suggest an allocation in part to diversify interest rate risk, are expected to outperform their Treasury counterparts over time.

U.S. Stocks

While all U.S. stock indexes were positive for the quarter, the Russell 1000 Growth (+3.2%) was the lowest-returning U.S. stock index we track over the quarter.

U.S. stock indexes have all gained > 25% over the last 12 months through 9/30/2024.

The top 10 stocks in the S&P 500 represent 35.8% of the index, indicating a high level of concentration, even well above the percentage during the internet bubble.

While the information technology sector dominated the S&P in Q2, Exhibit 3 shows it was laggard in Q3, returning only 1.6% relative to sectors like Utilities (+19%) and Real Estate (+17%). Similarly, while excitement behind artificial intelligence (AI) drove markets considerably higher earlier this year, there is now at least some concern that the level of spending on AI by the major players is not only unsustainable but has investors wondering if/when/how these bets on AI will ultimately be profitable.

Exhibit 3

Source: S&P, data as of September 30, 2024. Past performance is not indicative of future results.

We also know the U.S. has outperformed non-U.S. stocks over the last 10-15 years overall, and there are a lot of theories as to why it has happened. One of the prevalent theories is that the U.S. is simply friendlier to businesses.

The Heritage Foundation’s business freedom scores rank countries by four broad categories, including rule of law, government size, regulatory efficiency, and open markets.

As Exhibit 4 shows, the U.S. finds itself around the middle of the pack, ranking 13th out of 22 developed countries in 2023.¹ (1 The World Bank’s Ease of Doing Business score placed the U.S. among the top five of developed markets in its last production, but the series was discontinued in 2021).

Exhibit 4

Source: Past performance is not a guarantee of future results. Actual returns may be lower. Annual quintile rankings computed using business freedom scores from the Heritage Foundation. MSCI data © 2024, all rights reserved. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

More relevant than the level is the consistency of the U.S.’s ranking, and this poses a major challenge to explaining recent U.S. market performance through business freedom. The U.S.’s average ranking from 2006 through 2009 was about ninth. During the years since 2010, the average ranking fell slightly to 12th. So, the U.S.’s business appeal was essentially middle of the pack both during the back end of the “lost decade” and from 2010 to 2023. And yet the S&P 500’s relative return outcomes were polar opposite during these two periods, flipping from underperforming the MSCI All Country World ex USA Index by 4.0 percentage points to outperforming by 8.5 percentage points. This data casts doubt on the theory the US has done well because it is more business-friendly.

Non-U.S. Equity

Developed and emerging non-U.S. stock returns were all positive for Q3, outpacing their U.S. counterparts.

Expected stimulus package announcement in China supported their strong returns.

The U.S. dollar declined relative to a basket of other currencies, acting as a tailwind for non-U.S. stocks.

Let’s pay particular attention to China, as it was the second highest returning country over the quarter. China has outsized importance when it comes to emerging market returns simply because it assumes roughly 25.7% of the emerging market index, its largest country weighting (India and Taiwan are next at 24.9% and 21% respectively). The return in China came in late September after the Peoples Bank of China announced a significant stimulus package that would cut interest rates, provide support for the property market, and look to boost low consumer confidence. Will China follow through on the stimulus packages, and will they be enough to boost consumer confidence and bolster their property market?

Global REITs (Real Estate Investment Trusts)

Global REITs, as represented by the Dow Jones Global Select REIT, grew by 15.9% over the quarter and 30.4% over the last 12 months.

In the U.S., specialty REITs performed the best YTD (50.6%). Source: NAREIT.

Global Fixed Income

Bond returns were all positive for the second quarter.

While current cash and money market rates are currently attractive, this is not expected to continue if the Fed continues to lower the fed funds rate.

Exhibit 5

Source: Bloomberg, 9/30/2024.

As Exhibit 5 shows, U.S. Treasury rates declined across the entire yield curve versus last quarter end. Interestingly, while short-term rates are still above long-term rates, the curve has actually uninverted between 2-yr and 10-yr Treasuries (these are the maturities most often referenced when talking about yield curve inversion).

Overall, we continue to view our bond allocations as a method of reducing overall portfolio risk (as measured by standard deviation), given that stocks are expected to have much higher volatility. Our portfolio’s focus will continue to be on high-quality bonds with an emphasis on short- to intermediate-duration government and corporate bonds, where default risk has historically been relatively low.

East Bay Investment Solutions, a Registered Investment Advisory firm, supplies investment research services under contract.

This document contains general information, may be based on authorities that are subject to change, and is not a substitute for professional advice or services. This document does not constitute tax, consulting, business, financial, investment, legal or other professional advice, and you should consult a qualified professional advisor before taking any action based on the information herein. This document is intended for the exclusive use of East Bay clients, and/or clients or prospective clients of the advisory firm for whom this analysis was prepared in conjunction with the EAST BAY TERMS OF USE, supplied under separate cover. Content is privileged and confidential. Information has been obtained by a variety of sources believed to be reliable though not independently verified. To the extent capital markets assumptions or projections are used, actual returns, volatility measures, correlation, and other statistics used will differ from assumptions. Historical and forecasted information does not include advisory fees, transaction fees, custody fees, taxes or any other expenses associated with investable products unless otherwise noted. Actual expenses will detract from performance. Past performance does not indicate future performance.

The sole purpose of this document is to inform, and it is not intended to be an offer or solicitation to purchase or sell any security, or investment or service. Investments mentioned in this document may not be suitable for investors. Before making any investment, each investor should carefully consider the risks associated with the investment and make a determination based on the investor’s own particular circumstances, that the investment is consistent with the investor’s investment objectives. Information in this document was prepared by East Bay Investment Solutions. Although information in this document has been obtained from sources believed to be reliable, East Bay Investment Solutions does not guarantee its accuracy, completeness, or reliability and are not responsible or liable for any direct, indirect or consequential losses from its use. Any such information may be incomplete or condensed and is subject to change without notice.

Visit eastbayis.com or more information regarding East Bay Investment Solutions.