By Katie Cuccia Hebert, MBA, CFP®

In August 2021, we experienced the most devastating hurricane to ever hit our community. Nearly every structure had some type of damage, which meant now having to deal with insurance and determining the amount that insurance would pay for repairs. However, for those who sustained more damage than insurance would cover, you may be able to deduct these losses on your tax return as a casualty loss deduction.

What is a casualty loss?

According to the IRS, “a casualty loss can result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption. A casualty doesn't include normal wear and tear or progressive deterioration.”[1]

There are three types of casualty losses recognized by the IRS – federal casualty losses, disaster losses, and qualified disaster losses – and while the requirements for each of these losses varies, each is considered a federally declared disaster. The President of the United States determines if a disaster is a federally declared disaster, which not only provides government assistance to the affected area, but also allows individuals to deduct these casualty losses on their federal income tax return.

While the IRS does not (yet) consider Hurricane Ida to be a federally declared disaster, you can still deduct a casualty loss if you itemize your deductions on your federal income tax return.

When to deduct

Taxpayers have the option to claim the casualty loss deduction on their federal income tax return in the year of the loss or the year preceding the loss by amending your previous tax return. The election to deduct 2021 disaster losses on your 2020 tax return must be made by October 17, 2022, for individual calendar year taxpayers. The main reason you would want to claim the loss in the preceding year is if it results in a greater tax benefit than the tax benefit you’d receive by claiming the loss in the disaster year. Your tax professional can assist in determining what strategy is best for you.

Per the IRS website, “affected taxpayers claiming the disaster loss on a 2020 return should put the Disaster Designation, "Louisiana - Hurricane Ida" in bold letters at the top of the form. Be sure to include the disaster declaration number, FEMA 4611-DR, on any return. See Publication 547 for details.”

Proof of loss

You must have supporting documentation to justify the amount of your casualty loss deduction, including:

“That you were the owner of the property, or if you leased the property from someone else, that you were contractually liable to the owner for the damage.

The type of casualty (car accident, fire, storm, etc.) and when it occurred.

That the loss was a direct result of the casualty.

Whether a claim for reimbursement exists for which there is a reasonable expectation of recovery.”[2]

Calculating your loss

The amount of your casualty loss for personal-use property (residence) or damaged property is the lesser of:

Your adjusted basis in the property, which is the cost of acquiring your home plus any capital improvement costs minus any depreciation or casualty loss deduction; or

The decrease in fair market value (FMV) of your property caused by the casualty. This is the difference in the FMV immediately before and immediately after the casualty.

From the smaller of the two amounts above, subtract any reimbursements you have received or expect to receive. The deduction limits (discussed later) will then be applied to this figure to determine the amount of your deductible loss.

To determine the loss on a business or income-producing property, such as a rental property, that is stolen or destroyed, the decrease in FMV is not applied. The loss is calculated as follows:

Your adjusted basis in the property

MINUS

Any salvage value

MINUS

Any reimbursements you have received or expect to receive

Do insurance and other reimbursements impact my deduction?

The amount of your casualty loss is reduced by any reimbursement you received or expect to receive from insurance. This means even if you only received a partial reimbursement from your insurance company, but you expect to receive another reimbursement from your insurance company for this loss, you must reduce your loss by the total reimbursement amount you expect to receive, even if you do not receive payment until a future tax year.

If there is insurance coverage on your property but you do not file an insurance claim, you may only deduct the part of the loss that is not covered by your insurance policy, rather than deducting the full unrecovered amount. However, this rule does not apply to losses that are generally not covered by insurance, like a deductible.

Example. Your car insurance policy includes comprehensive coverage with a $1,000 deductible. Because your insurance doesn’t cover the first $1,000 of damages resulting from a storm, the $1,000 is deductible (subject to the $100 and 10% rules, discussed later). This is true, even if you don’t file an insurance claim, because your insurance policy won’t reimburse you for the deductible.[2]

Any disaster relief money and any funds received from your employer’s emergency disaster fund that are used towards replacing or repairing your damaged or destroyed property in which you are claiming a casualty loss deduction will also reduce the amount of your casualty loss deduction.

Example. Your home was extensively damaged by a tornado. Your loss after reimbursement from your insurance company was $10,000. Your employer set up a disaster relief fund for its employees. Employees receiving money from the fund had to use it to rehabilitate or replace their damaged or destroyed property. You received $4,000 from the fund and spent the entire amount on repairs to your home. In figuring your casualty loss, you must reduce your unreimbursed loss ($10,000) by the $4,000 you received from your employer’s fund. Your casualty loss before applying the deduction limits (discussed later) is $6,000.[2]

The following do not reduce the amount of your casualty loss:

Cash gifts received as a disaster victim with no stipulation as to how the proceeds are to be spent, even if used to repair damaged property.

Insurance payments you receive to cover temporary living expenses when (1) you lost the use of your home due to a casualty or (2) there is a casualty or threat of a casualty, and the government does not allow you to access your primary residence.

If the insurance payments you receive are higher than the temporary increase in your living expenses, this excess amount is included in your income unless the casualty occurs in federally declared disaster area, in which case the excess amount is not taxable.

Disaster relief grants

Loan proceeds used to repair or replace your damaged or destroyed property in which you are claiming a casualty loss deduction.

Deduction limits

In addition to itemizing on Schedule A, your casualty loss must also exceed 10% of your adjusted gross income to take advantage of a casualty loss deduction. In calculating the amount of your casualty loss deduction, personal-use property (i.e., your residence) is subject to the $100 rule.

Once you subtract your reimbursements and determine the amount of the casualty loss, you would then reduce each casualty loss by $100 and then reduce that further by 10% of your adjusted gross income to determine the amount of your deduction.

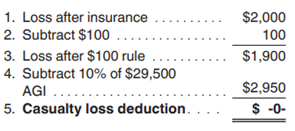

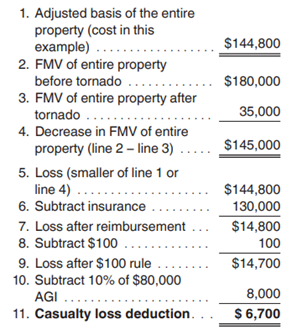

Example 1:

Example 2: In June, a tornado destroyed your lakeside cottage, which cost $144,800 (including $14,500 for the land) several years ago. (Your land wasn’t damaged.) This was your only casualty or theft loss for the year. The FMV of the property immediately before the tornado was $180,000 ($145,000 for the cottage and $35,000 for the land). The FMV immediately after the tornado was $35,000 (value of the land). You collected $130,000 from the insurance company. Your adjusted gross income for the year the tornado occurred is $80,000. Your deduction for the casualty loss is $6,700, figured in the following manner.[2]

These rules apply only to personal-use property and do not apply to losses sustained to business property or income-producing property.

Capital gain/personal casualty gain

If the reimbursement amount you receive is greater than your adjusted basis in the property, you have a capital gain, which, unless you are eligible to postpone or exclude reporting the gain, is included in your income in the year you receive the reimbursement. Personal casualty capital gains may be deducted against personal casualty losses not attributable to a federally declared disaster in a given tax year if the losses do not exceed the amount of personal capital gains.

Adjusting tax return after reimbursement

If your reimbursement is less than you anticipated (and reported on your tax return), include that difference as a loss on your tax return in the year you can reasonably expect to no longer receive any reimbursement.

If you receive a larger than expected reimbursement and have already claimed a casualty loss deduction, the gain may be included in your income in the year received to the extent the casualty loss deduction reduced your tax in the earlier year.

Next steps

Be sure to keep adequate records regarding your hurricane damage as well as any payments you receive or expect to receive from insurance. We recommend consulting with your tax advisor to ensure these types of losses are reported correctly on your tax return.

If you are a current client of our firm and are curious as to the impact of taxes on your financial plan, let us know. If you do not have a financial plan and want clarity about your financial future, schedule a 30-minute discovery call with one of our Wealth Advisors to learn more about how we can help.